Plan Overview

The Legislature passed the LARGEST teacher pay raise plan in Oklahoma history

- Gov. Fallin has already signed it

Moves Oklahoma to NUMBER 2 in the REGION for teacher pay

- Moves Oklahoma from 48th Nationally to 34th (12th when factoring cost of living adjustments)

- Oklahoma is already FIRST in the REGION for Benefits

The Teacher Pay Raise is ALREADY FUNDED

The Legislature already passed (and Governor signed) the FY-2019 education budget

- The budget was a 19.74 percent INCREASE (more than $480 million) over the FY-2018 education budget

- Included funding for:

- Teacher Pay Raises = $353.5 million

- Support Staff Pay Raises = $52 million

- Textbooks = $33 million

- Flex Benefits = $24.6 million

The plan adjusts the statutory minimum salary schedule

- The state is on the hook for the raises every year

Every teacher will receive a minimum $5,000 pay increase on AUGUST 1

- Raises will be based on experience and education level

- A teacher with 25 years of experience and a doctorate degree will receive a nearly $8,400 raise

- 15-18 percent increases on average

- $6,100 average pay increase

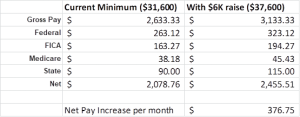

AVERAGE NET PAY

Funding Mechanisms for Teacher Pay Raise Plan

House Bill 1010XX

- Raises $405 MILLION Annually

- Tobacco Tax

- Adds 50 mills/cigarette tax ($1.00/pack) on cigarettes

- Adds 50 mills/cigar tax on little cigars

- Gross Production Tax

- Increases GPT on all wells from 2 percent to 5 percent

- Motor Fuel and Diesel Tax

- Increases tax on gasoline .03 cents/gallon and diesel .06 cents/gallon

- Hotel/Motel Lodging Tax

- Adds a $5 per room lodging tax on rented rooms

- HOUSE REPEALED (Senate would not pass HB1010 with lodging tax)

- DOES NOT AFFECT TEACHER PAY RAISES

- Those have already been funded with passage of education budget

- IT DOES create a $32 million shortfall that must be addressed

- MULTIPLE OPTIONS available to replace that $32 million

- Chairman Wallace expects a surplus from FY-2018 growth revenue

- REVOLVING FUNDS

- 51 VOTE measures

- Still TWO MONTHS of session left to craft a budget for remaining agencies

House Bill 1011XX

- Raises $84 million annually

- Places cap on itemized deductions (exempts charitable and medical expenses)

THE STATE IS NOT TAXING TEACHERS TO PAY FOR THEIR OWN RAISE

- The average teacher will see a NET increase in pay of nearly $400/month

- The average driver will pay approximately $1/month extra in fuel costs

- Motor Fuel Tax (.03 cents/gallon)

- FY-2019 = tax will raise $52 million DIVIDED by 2.6 million drivers = $20/year or $1.06/month

- And ODOT estimates up to 40 percent of motor fuel purchased by out-of-state drivers